Die besten ETF-Themen |

Performance (Kursentwicklung & Ausschüttungen) | |||||

|---|---|---|---|---|---|---|

| 5J | 3J | 1J | 2026 | 3M | 1W | |

| Aktienfonds All Cap | n.a | 207.57% | 86.16% | 21.53% | 46.75% | 6.70% |

| Aktienfonds Biotechnologie | 21.18% | 29.32% | 16.91% | 5.30% | 6.66% | 3.67% |

| Aktienfonds Rohstoffe Edelmetalle | 302.70% | 327.24% | 137.57% | 20.26% | 33.04% | 3.45% |

| Aktienfonds Infrastruktur | n.a | 72.62% | 17.53% | 15.63% | 18.41% | 2.25% |

| Aktienfonds Industrie | n.a | 78.58% | 23.44% | 9.54% | 15.78% | 2.06% |

| Aktienfonds Technologie | 235.22% | 257.15% | 42.98% | 12.73% | 15.84% | 1.97% |

| Strategiefonds Aktien-Strategie Equity Leverage | 122.99% | 179.25% | 0.34% | -4.55% | -2.17% | 1.88% |

| Strategiefonds Options-Strategie dynamisch | n.a | 32.05% | -10.24% | 0.02% | 1.91% | 1.62% |

| Aktienfonds Gesundheit / Pharma | 54.68% | 27.94% | 7.98% | 8.03% | 11.44% | 1.51% |

| Aktienfonds Immobilien | n.a | 30.88% | 24.44% | 10.00% | 10.56% | 1.30% |

| Aktienfonds Konsum | 48.09% | 48.40% | -8.82% | -3.43% | 0.97% | 1.28% |

| Mischfonds ausgewogen | 27.88% | 20.72% | 5.99% | 6.44% | 6.38% | 1.21% |

| Mischfonds flexibel | 11.41% | 27.59% | 11.07% | 8.53% | 11.93% | 0.79% |

| Aktienfonds Kommunikation | 86.94% | 108.99% | 2.32% | -2.45% | -0.14% | 0.57% |

| Aktienfonds Finanz-Dienstleistungen | 319.09% | 172.74% | 60.83% | 1.74% | 15.26% | 0.48% |

| Strategiefonds Renten-Strategie Bond L/S | 13.02% | 11.97% | 2.03% | 0.32% | 0.52% | 0.08% |

| Rentenfonds Unternehmensanleihen nachrangig | 10.54% | 26.09% | 5.40% | 1.15% | 1.64% | -0.01% |

| Rentenfonds Unternehmensanleihen Investment Grade | 11.98% | 20.57% | 0.65% | 0.68% | 2.74% | -0.16% |

| Aktienfonds Versorger | 79.00% | 65.11% | 46.94% | 10.76% | 13.88% | -1.68% |

| Aktienfonds Rohstoffe Industriemetalle | n.a | 115.44% | 95.92% | 19.92% | 45.90% | -1.72% |

| Aktienfonds Rohstoffe gemischt | n.a | 48.05% | 95.61% | 17.44% | 30.70% | -1.77% |

| Aktienfonds Rohstoffe Agrar | n.a | 1.73% | -8.85% | 10.58% | 17.71% | -2.41% |

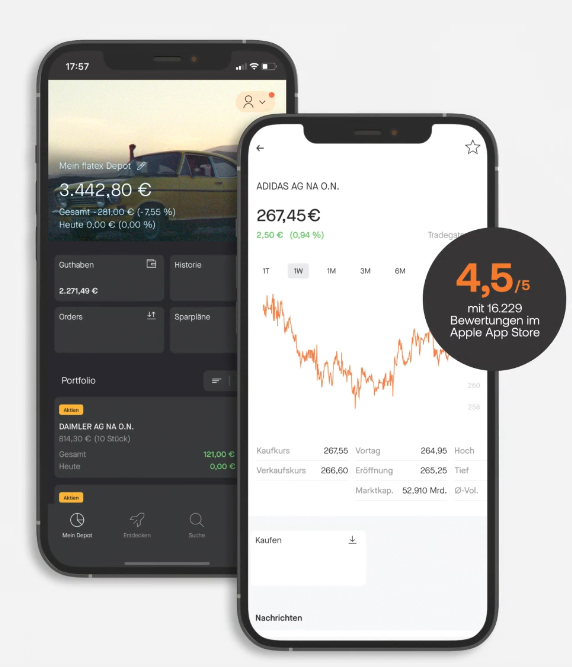

Aktuelle Depot-Neukundenaktionen

Jetzt bei Consorsbank für Depotübertrag

Jetzt bei Joe Broker für Depoteröffnung

Jetzt bei justTRADE für Depoteröffnung